How Does a Mutual Scheme Stack Up Against Commercial Insurance

Let’s see the theory behind the two alternatives and where schools’ money goes.

The Basics

If you consider a group of schools with a particular set of terms and conditions and benefits and parameters, then over a period of time they will expect to receive exactly the same amount of payments no matter how they decide to insure/cover/reimburse themselves. Therefore whoever operates the scheme/insurance needs to collect that money to pay out to schools along with some additional funds.

Commercial Insurance

Mutual Scheme

Payout Amount

Administration costs – Staff are needed to run the scheme and therefore the cost of these must be factored in.

Contingency Overheads – The administrators of a scheme often included overheads such as contingency or a reserve. The level of contingency can depend on how good the managers of the scheme are at estimating the claim costs accurately. With insurance any surplus is retained by the insurers as additional profit. With a mutual any surplus can be returned to schools either as a payment or as reduced future contribution charges.

Underwriter Profit – between 5 and 15% for insurance, 0% for a mutual. This is charged by the underwriters as an incentive for them to take the risk in providing the financial backing for the fund.

Broker Profit – between 15 and 30% for insurance, 0% for a mutual. This is the profit element that brokers require in order to facilitate the organisation and operation of an insurance arrangement.

Insurance Premium Tax (IPT) – 12% for insurance, 0% for a mutual. This is levied on top of all the other costs, so it can easily add to as much as 20% of the original claim costs.

Stoploss insurance – 4% for a conventional mutal, can be reduced eventually to 0% for an Esphera backed mutual by building up a reserve. This is needed by most schemes to cover the eventuality of the scheme breaching predefined claim limits and potentially bankrupting the scheme.

So it’s quite easy to see where a load more money goes and where you can save it. The key thing is to reduce the amount of contingency and administration overheads, which is reliant on accurately predicting future absence levels and having the correct tools to see through the myriad of information.

But just how much extra are schools paying for insurance? One of our most recent customers set up a new scheme because schools were paying 50% more than necessary and it proved so simple to make significant savings from the very start.

The Numbers

-

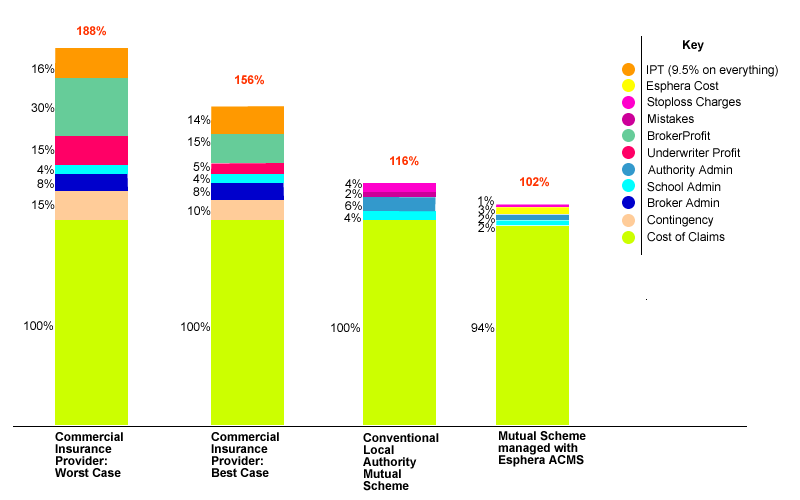

For any given expected claim volume external insurers will add in their administration costs, contingency, profit margins and IPT at 12% of the total which ends up costing the schools between 150 – 190% of the amount they can expect to see returned to them.

-

Running your own mutual scheme significantly reduces the overall cost to schools to approximately 116% of the expected claim volume so you can immediately see a 30%+ improvement. But it takes experience and knowledge of the marketplace to ensure mistakes are not made.

-

Esphera’s Absence and Claims Management System, if used to manage your fund, will reduce the overall costs even further. Even with all costs added in, because so many efficiencies are made, the general level of claims will be reduced and the schools only have to be charged approximately 102% of the original expected cost of claims (on average). These are just the tangible financial benefits.

-

Intangible benefits include higher buy-in levels from schools, reduced volatility, easier administration, less hassle, greater satisfaction, employing staff in the public sector instead of funding employees in insurance companies.

-

Running a simplified or non-optimised scheme dramatically increases the chances of the scheme failing, as we see each year with more authorities schemes collapsing in the face of stiffer competition from commercial insurers. A failed scheme costs the schools significantly more and costs jobs at the local authority. Unless you can afford to run that risk, let us optimise your scheme and make running your scheme simpler?

The Inescapable Facts

- If there is no opportunity for schools to participate in a mutual staff sickness mutual fund then they will be paying commercial providers at least 30% more a year on average to cover their supply staff costs than is necessary. That’s simply from the profit the insurance companies have to make, broker fees and insurance premium tax which is added on top of all the other costs.

- As a result the authorities with the lowest cost per staff FTE currently run their own defined benefit mutual schemes. If you already operate an absence and/or maternity scheme for schools’ supply staff costs and you are not controlling it using a bespoke system designed specifically to manage it effectively then you could be saving much more. There is only one system available that has been developed with other authorites help to enable you to easily acheive this.

- The Esphera Staff Absence and Claims Management System will optimise the running of your scheme and typically could save you £450,000 each year on a £3m fund.

- Typical savings are 15% of fund value. Approximate cost are 2-3% of fund value. Why wait to implement this self funding solution?

- The system can be configured in a few weeks, has no impact on authority IT and can be saving you money from the outset.

- The longer action is delayed the more schools’ money is being wasted.